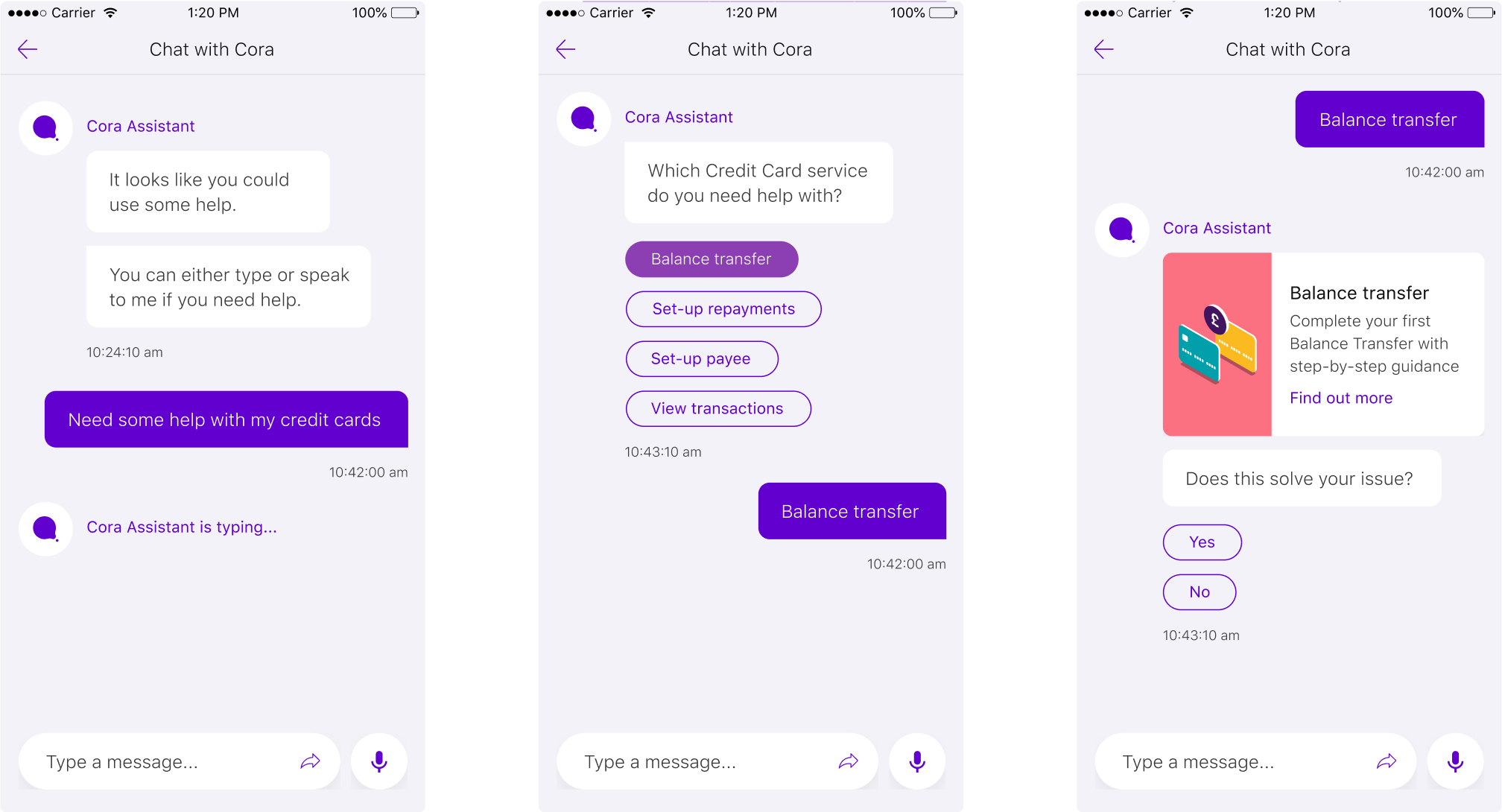

Helping an iconic British bank evolve to stand tall against challengers and attract new customers with a mobile app used by 8 million people.

As a Product Designer in the client-side Publicis Sapient team at Natwest, I’ve had the chance to re-imagine the mobile experience for the banking app, collaborating hands-on from research to final delivery in a number of features during the course of 12 months.

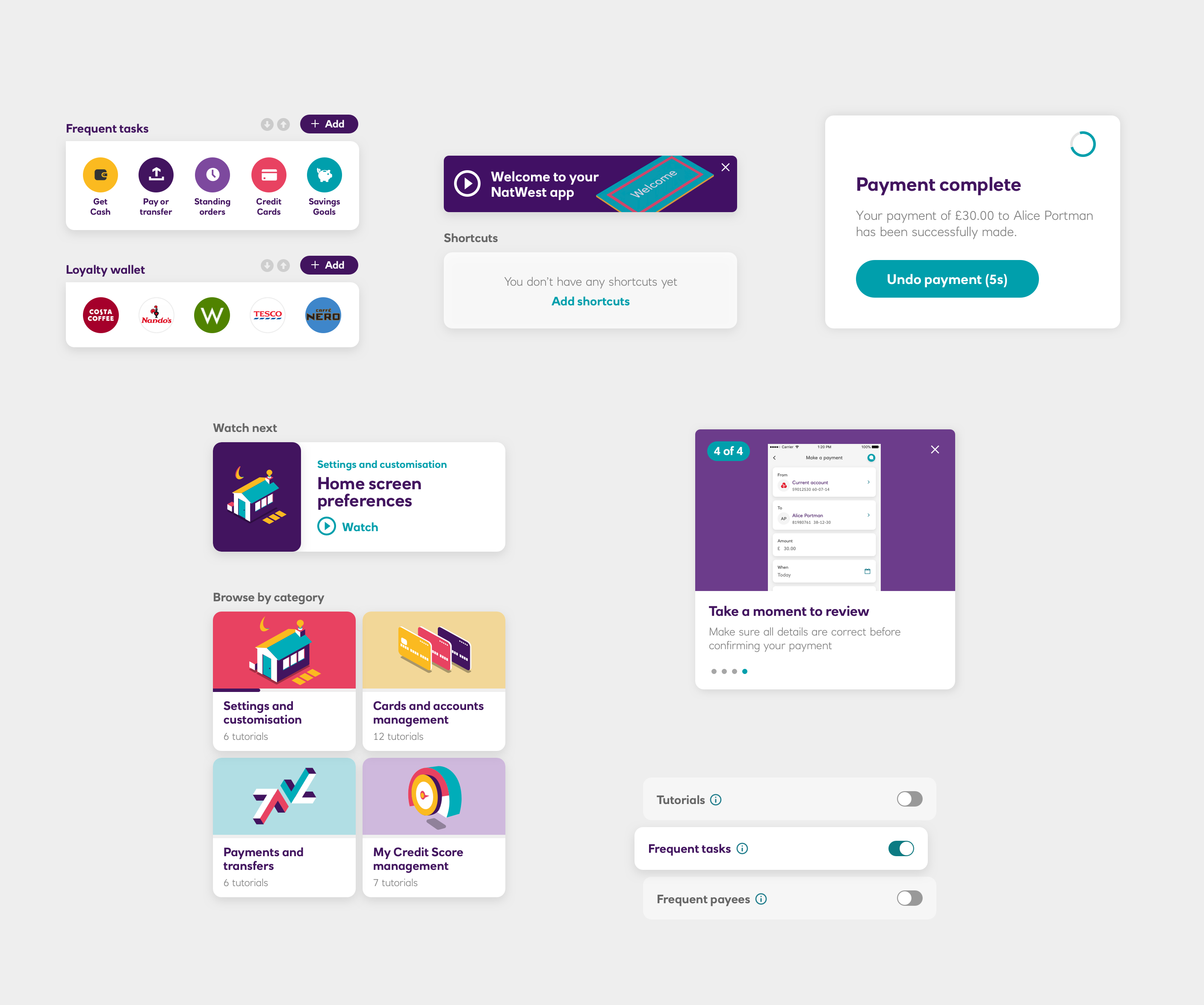

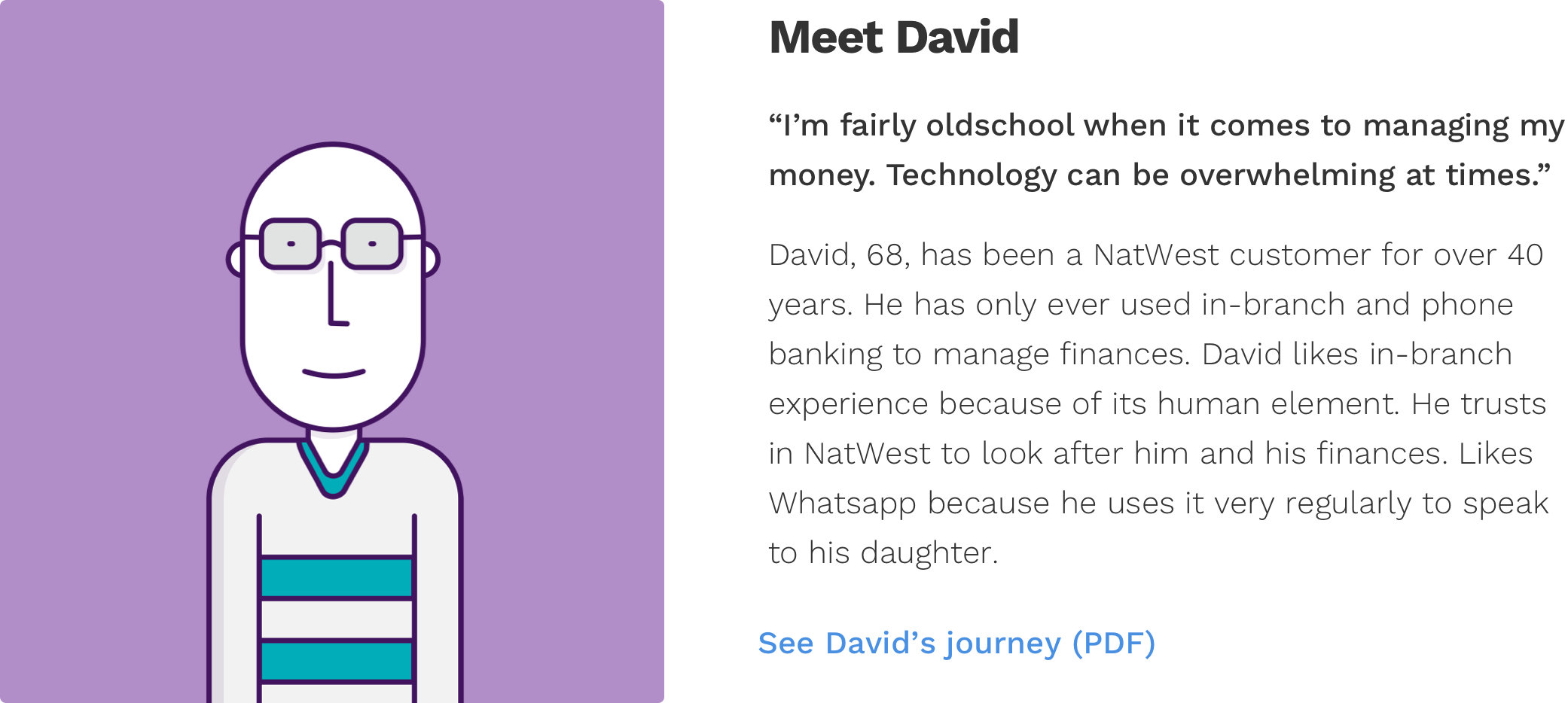

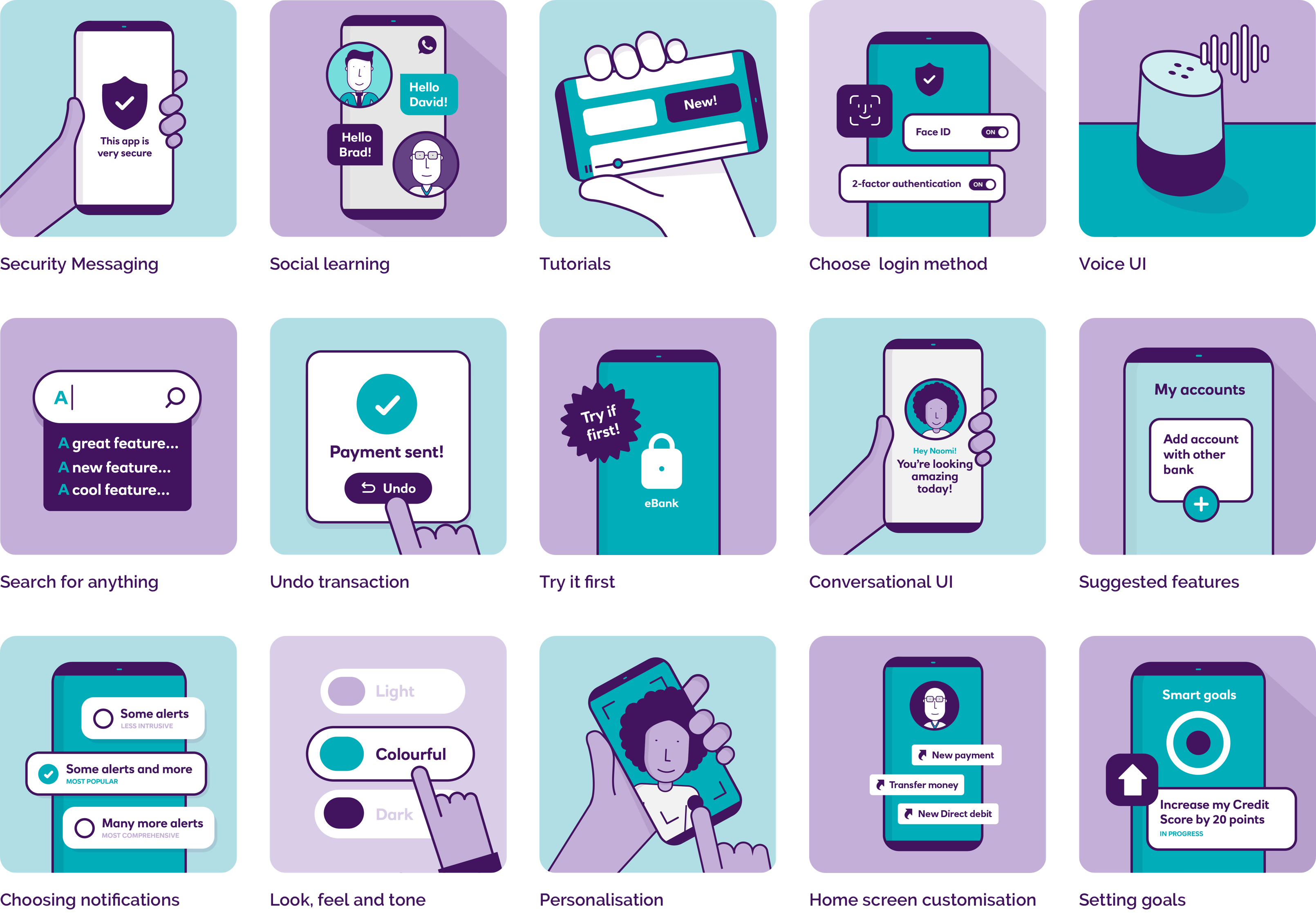

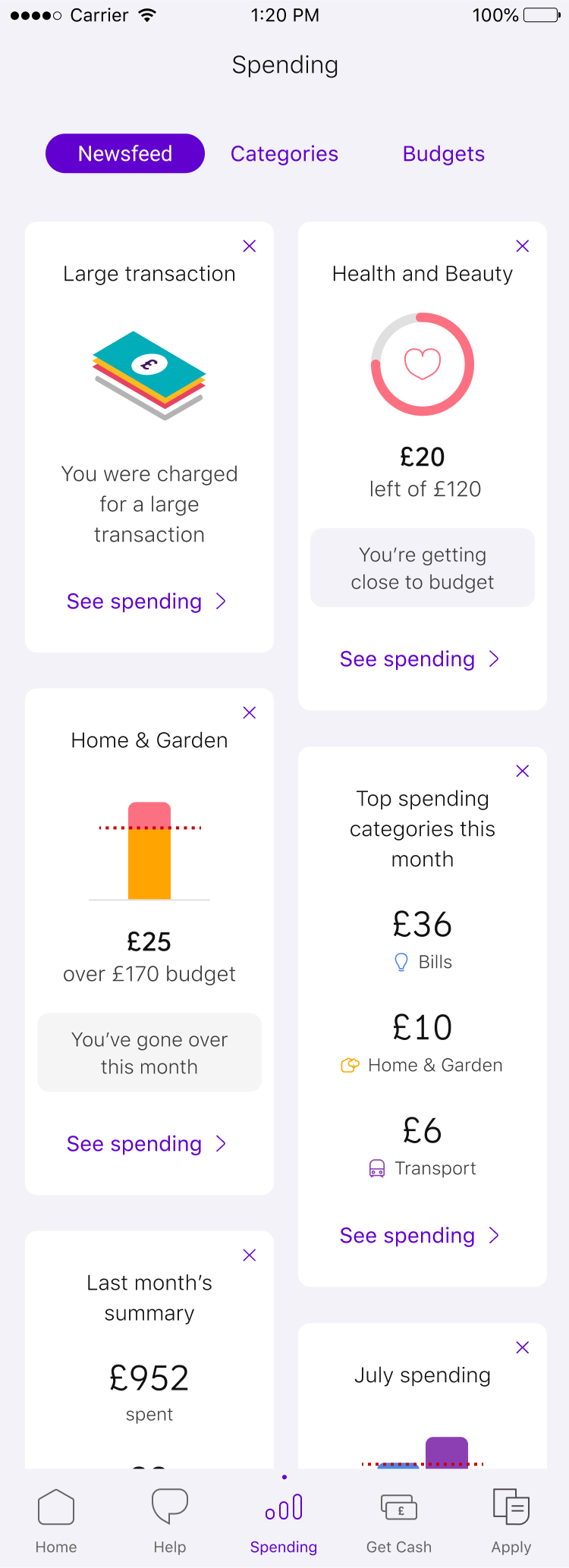

I worked closely with the research team to understand customer pain points and barriers for new and improved features around three main themes: registration/login, security and personalisation. The findings collected throughout this process paved the way for rolling out new features and refreshing the look-and-feel of the app.

In a combined effort across disciplines and streams of work, our team were able to greatly improve the mobile banking experience, making it easier, more personalised, more secure and more memorable than ever.